✏️ Editor’s Note: Realtor Associations, agents, and MLS’ have started implementing changes related to the NAR’s $418 million settlement. While home-sellers will likely save thousands in commission, compliance and litigation risks have significantly increased for sellers throughout the nation. Learn how NAR’s settlement affects home sellers.

Offerpad is the 2nd biggest iBuyer in the U.S. They make fast offers and close quickly. But with rising interest rates and declining home prices in 2024, iBuyers are making offers that are significantly below market. Offerpad is likely no exception.

Should You Sell to Offerpad?

- Pros: Offerpad offers convenience with their cash offers and fast closings.

- Cons: Strict eligibility criteria, limited coverage, and 1% cancellation fees make Offerpad less appealing. In 2023, all investors and iBuyers will likely offer much less for homes to budget for declining prices.

- 👉 Our Take: We recommend you list on the MLS via Houzeo. Your property will be exposed to local and national cash buyers, including Offerpad. And you can choose the best offer you get.

What is Offerpad?

| Offerpad Fees | Offerpad charges 6% – 11% of your cash offer. This varies based on various factors such as condition, location, etc. |

| Cancellation Fee | Offerpad charges a 1% cancellation fee |

| Offerpad Express | Offerpad directly buys your house from you for an upfront cash offer. |

| Offerpad Flex | You can list your property with their partner agents and obtain a cash offer. You can activate your offer for up to 60 days when listed on the market. |

| Serviceable Markets | Offerpad covers 24 U.S. Markets, 16 states, and over 1700 cities |

Offerpad is an iBuying real estate company that makes almost instant cash offers on houses. Usually, iBuyers close deals in two weeks or less. Offerpad claims to sell the homes in only 8 days.

Offerpad’s business model is backed by advanced technology, comprehensive data analytics, and a bunch of experienced in-house market experts. Reviews of Offerpad are a blend of smooth home selling experiences and questionable customer support.

Founded by Jerry Coleman and Brian Bair in 2017, Offerpad is the second-largest iBuyer by purchase volume. However, due to its strict purchase criteria, it purchases fewer homes than Opendoor, but still more than RedfinNow and other iBuyers.

If you’re looking to streamline the home selling services without the traditional hassles of listing – iBuyers like Offerpad could be a great option. But is Offerpad a good deal? Since the service fees and repair deductions charged by Offerpad can eat a substantial amount of your profits.

This leaves you with less money than you would get if you were to sell your house on the open market as For Sale By Owner.

Is Offerpad Legit?

Yes, Offerpad is a legit company. Offerpad reviews on reliable websites like TrustPilot and Yelp support the legitimacy of this real estate company.

You will have only four days to decide whether or not to proceed with the deal after receiving the final cash offer and a necessary house inspection. Offerpad will charge you a 1% cancellation fee if you wish to cancel the arrangement.

On the contrary, low-commission real estate companies like Houzeo give your listing more visibility in exchange for a nominal flat fee. This not only increases the reach but also gives you the liberty to choose the best offer from multiple ones.

Where is Offerpad Available?

Offerpad has homes for sale in 16 states and over 1700 cities across America.

Offerpad Buying Criteria

Let’s look at Offerpad’s eligibility criteria:

What Type of Houses Does Offerpad Buy?

Like Opendoor, you must meet Offerpad’s strict criteria for them to buy your home. They are very particular about the homes they purchase to qualify.

- Markets Covered: Has to be within the 24 markets Offerpad covers

- Built: Should be built after 1960

- Type of Homes: Residential homes – single-family homes, condos, and townhouses

- Housing Prices of Property: Should be less than $1 million (varies according to market)

- Plot size: Should be less than 1 acre of land

If your home faces a hurdle in the title or does not meet the above-mentioned criteria, Offerpad will not buy your house. Many Offerpad reviews state how home sellers have faced trouble due to these inflexible terms.

Buying a Home From Offerpad

Offerpad’s tech-focused platform provides a variety of benefits for homebuyers. Buying a home from Offerpad is a breeze. Aside from a flexible moving date, Offerpad provides a professional transaction manager to help you throughout the process. Their other features include:

Instant Access: Homebuyers may view and self-tour Offerpad houses whenever and wherever they want. You get additional benefits like making an offer and getting all property details upfront.

Agent on Demand: Buyers can also view homes in the area, offer feedback, and request an agent on demand, where an independent local agent assists them throughout the process.

Lastly, Offerpad does not charge any additional fees to the buyer. The only costs involved in your buying process include closing costs, a down payment, the appraisal fee, and inspection fees, depending on the property location.

How Does Offerpad Work?

Selling to Offerpad differs greatly from selling a house with a traditional realtor. Whether you’re a home buyer or a seller with Offerpad, you will work with their internal team and third-party vendors.

Offerpad employees rely on their professional experience and the company’s algorithm to evaluate homes listed online. This process determines cash offers based on fair market price and establishes a price for the homes available for sale.

While this process may sound like a cakewalk, it also involves you coordinating with several points of contact from Offerpad and third-party vendors. Again, the prices evaluated for your property are not provided to you, which means you may have no idea how and on what basis the price was set.

How to Sell to Offerpad?

Selling to Offerpad Express

Offerpad reviews suggest the process of selling your house to the iBuyer can be summed in 5 easy steps.

Step 1: Submit Your Information

You will have to submit an elaborate set of details to receive the initial cash offer. The website will take you through a brief questionnaire, asking for details such as:

- Area of your property

- The layout of the property

- Year of build

- Legal and Illegal home renovations

Step 2: Accepting the Offer

Once you receive the initial cash offer, you have 4 days to accept or reject it before it expires. You can renew the offer but with no guarantee of the offer being higher, lower, or the same.

When you accept the offer, Offerpad makes you sign a legally binding contract without knowing how much money you will ultimately receive from the sale. Without signing the contract, you cannot proceed to the next step.

Step 3: Complete the Inspection

When it comes to a reasonable cash offer, Offerpad inspections are one of the most important steps to consider. Once you decide to sell to Offerpad, they will schedule a house inspection with a representative within 15 days. This part will be similar to the traditional sale. The process will last around two hours, going through every inch of your property and looking for issues such as water damage, structural problems, and general wear and tear.

One of the main Offerpad’s requirements for a home inspection is for the homeowner to be present during the process. This works in your favor so go along and ask questions to the inspector as he does his job. This will avoid any last-minute surprises.

Step 4: Receive an Updated Cash Offer

After the inspection, Offerpad will provide you with a list of necessary repairs and the estimated cost to fix them. Now, Offerpad can revise its cash offer or revoke it entirely if your house does not meet its criteria.

If you proceed as planned, you have two options to move to the next step:

- Accept a credit against the estimated costs of repairs

- Hire contractors to fix the repairs listed by the inspection team and make the house brand new

In case of pricey repairs, you will have to accept credit from Offerpad to make repairs. If you don’t accept the credit here, you won’t be able to proceed with the transaction.

Again, please note – that you have only 4 days to accept or decline their offer. Once the offer is expired, Offerpad will levy a 1% cancellation fee for not responding to their offer.

Reviews on Offerpad on trusted sources like Yelp and Sitejabber suggest confining the home seller within this arrangement is their biggest red flag.

With Houzeo, you can browse, register, and inquire without any obligations to proceed ahead. Houzeo eliminates all tight windows, thus allowing you to have a smooth and flexible home selling experience.

Step 5: Closing

Offerpad stands apart from other iBuyers with its flexible closing timelines. With Express final sale, you can choose any closing date anywhere from 8 to 90 days after accepting Offerpad’s offer.

And with their Extended Stay program, you can extend your stay at your own house after the closing date.

Offerpad will schedule a visit two days before closing to inspect whether the repairs are fixed. Unfinished or unsatisfactory repairs can cause delays in closing. You can close the deal once they give you a heads-up. Having said that, you will be liable to pay the closing costs – which are typically 1% – 3% of the purchase price.

Offerpad will offer title services, depending on your state.

| Type of Title Company | Name of the State |

| First American Title | Arizona, Colorado, Florida, Indiana, Nevada, Tennessee |

| Statewide Title | Alabama |

| Law offices of McMichael & Gray | Georgia |

| Law offices of Hankin & Pack | North Carolina & South Carolina |

Can I Back out of Selling My House Before Closing?

Yes.

You have the right to cancel the sale if you change your mind after signing the purchase agreement.

However, if you cancel because you and Offerpad are unable to reach an agreement on repairs and home conditions, you will be required to pay a charge equal to 1% of Offerpad’s offer price. Neither party owes anything if the iBuyer decides to back out of the agreement.

Selling With Offerpad Flex

Let’s see how Selling with Offerpad Flex works:

Step 1: Getting a Cash Offer

Offerpad Flex allows you to list your property with their partner agents and obtain a cash offer. You’ll start the procedure in the same way you did with Express. i.e., by answering detailed questions regarding your property, you can find out how much the offer pad is willing to pay for it.

You have the flexibility of activating your offer for up to 60 days when listed on the market.

Step 2: Recommended Repairs

If you decide to sell your home on the open market, you’ll need to make all of the cosmetic improvements you can. Offerpad advances the funds you need to do the necessary modifications so you can offer your home for a better price.

The cost of repairs is then deducted from the sale proceeds. You’ll be allocated to an experienced project manager and have access to a large network of connections that can help you save money.

Step 3: Sell to a Buyer

You completely control how long you want your house to be on the market. If your conditions change or if you simply do not want to end showings and close on your timeframe, you can continue, however, you may not be eligible for the cash offer.

Step 4: Accepting a Cash Offer

If your open market listing fails, you have up to 60 days to change your mind and accept Offerpad’s initial offer.

👉 Note: Please review eligibility with your Offerpad Flex representative, as not every home or customer will qualify for the backup cash offer.

Offerpad Fees

When you choose Offerpad over any Flat Fee MLS Websites, you will pay several additional fees, which may not be competitive with a For Sale By Owner website in your area. Does Offerpad charge closing costs or a repair fee? Let’s break it down further.

| Offerpad Express | 5% |

| Offerpad Flex | 6% |

| Closing Costs | 1% to 3% |

| Offerpad Repair Costs | 1% to 2% |

| 🚩 Cancellation fee | 1% (if you cancel post the 4-day-cancellation windows) |

| Total Cost | 9% to 12% |

If you calculate it correctly, you will pay between 9% and 12% of the purchase price of your property on service fees and closing costs.

Offerpad Hidden Fees

No, Offerpad does not charge hidden fees. However, it is not explicitly stated that they charge a 1% cancellation fee. You get a turnaround time of 4 days, within which you will be allowed to back out of their initial offer without a fee.

When you opt for Flat Fee MLS websites over selling through iBuyers, you open the door for broader reach, flexible plans, a seamless home selling experience, and more savings. Real estate websites like Houzeo have no hidden fees, thus giving you a transparent platform to list your home.

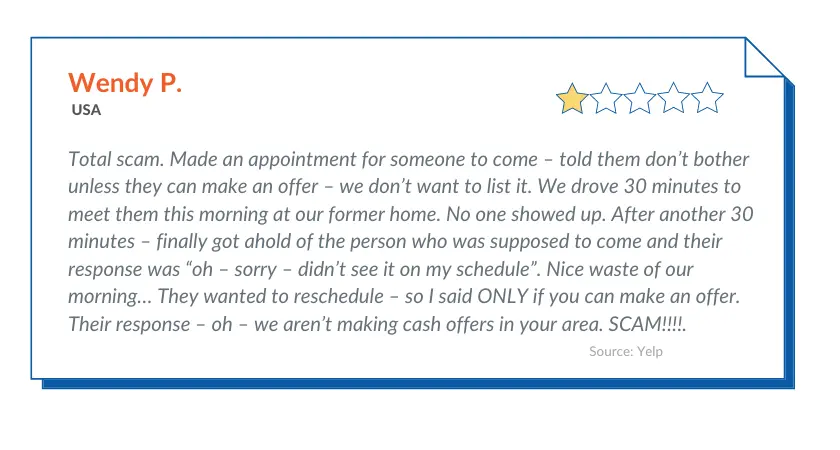

Offerpad Reviews

The majority of Offerpad reviews are positive, with an average rating of 4.6 on Trustpilot. According to multiple reviews, some house sellers have been satisfied with their services, but others have severe complaints about this iBuyer.

Offerpad Reviews: What Home Sellers and Buyers Liked

The common thing observed about positive Offerpad reviews is the flexibility in timelines and quick services.

✅ Flexible Closing Date: With no showings and the convenience of choosing your closing date, Offerpad simplifies selling for cash offers. Sell your home in as-is condition for a decent cash offer.

✅ Professional Agent Support: In comparison to other Offerpad serviceable locations, some have a strong agent network. They are knowledgeable and will walk you through the process. When you work with experts, the process of selling your house becomes much easier.

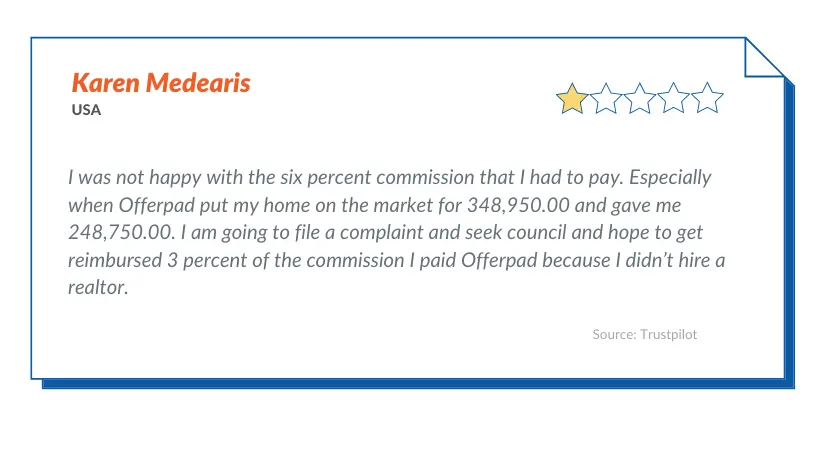

Offerpad Reviews: What Disappointed Customers the Most

Offerpad complaints are mostly about the final offers which are often below the market standards that collapse by thousands of dollars after the inspection and other charges.

❌ Offerpad Home Buying Reviews: Many sellers were being offered lower than the pre-deduction selling cost. Their 6-10% commission fee is greater than a standard full-service agent’s fee of 6% (this includes the buyer agent commission). When you factor in closing fees, you’re selling your home at a loss in exchange for the convenience of cash investors and buyers. There will always be better cash buyers on the market with lower service fees.

❌ Bad Customer Service: Condescending and unhelpful customer service can be a huge blow, especially in the home-selling business. Many Offerpad complaints mention the unhelpful representatives or inexperienced agents that fail to guide or advise you throughout the process.

Houzeo Reviews: Houzeo boasts 4.9/5 stars on popular social review sites Google and Trustpilot. Read some today!

❌ Lack of Agent Competency: Although they provide professional agent support, many reviews of Offerpad, question their competency. In addition to limited coverage, customers have often complained about their agents not being serious about the deal and wasting the seller’s time. This could also be a result of the large number of clients a single agent deals with at any given moment.

Is Offerpad Worth Your Money?

The main attraction of Offerpad is its quick sales for qualified sellers. However, factors including eligibility, limited coverage, and cancellation fees make it a less appealing option. Most home sellers are unaware that listing a house on the MLS makes it easy to sell a house in competitive markets.

Even if you aren’t a licensed broker, flat fee MLS services like Houzeo allow you to list on the open market. When you list on the MLS with Houzeo, you get a personalized dashboard, a 100% online platform, and prompt customer service—all for a fixed fee. And you can do it all on your phone!

🚀 List on MLS with Houzeo: You can finish the listing formalities in less than 1 hour, start NOW!

Frequently Asked Questions About Offerpad Reviews

1. Does Offerpad negotiate with buyers?

No, Offerpad's first offer is a take-it-or-leave-it proposition. However, in the event of an error, you can request a revaluation.